January 16, 2024

Indicators Signal Growth Over Next 6 Months

December 2023

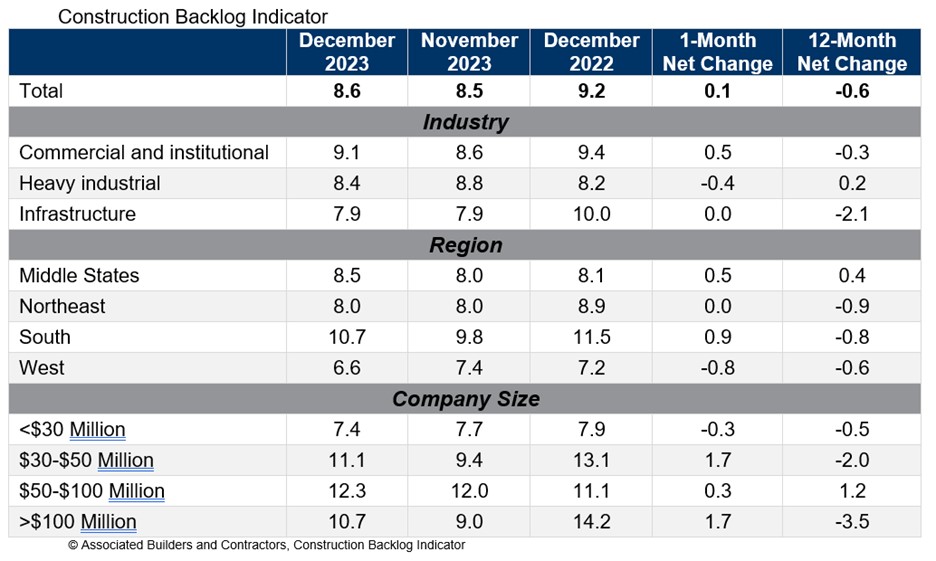

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 8.6 months in December from 8.5 months in November, according to an ABC member survey conducted Dec. 20 to Jan. 4. The reading is down 0.6 months from December 2022.

View the full Construction Backlog Indicator and Construction Confidence Index data series.

Construction Backlog Indicator

The South, which remains the region with the lengthiest backlog, posted the largest monthly increase in December. Only the West, which historically reports the lowest backlog of any region, experienced a monthly decline.

Construction Confidence Index

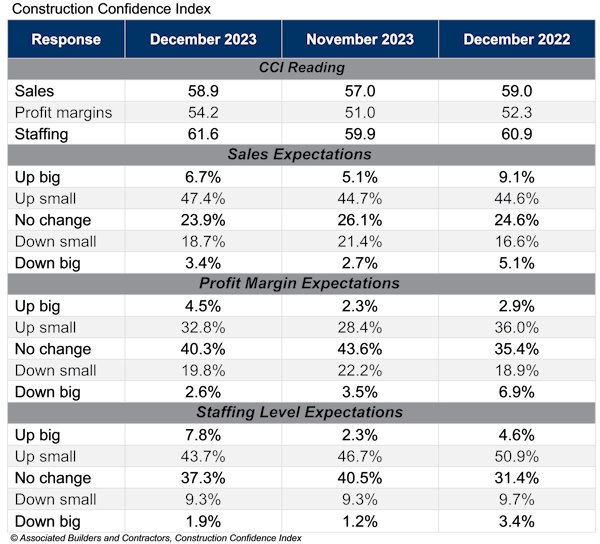

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in December. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“Collectively, contractors experienced an uptick in optimism during the holiday season,” said ABC Chief Economist Anirban Basu. “Credit conditions eased a bit during the last days of 2023 as the Federal Reserve indicated that its next set of moves will be to reduce borrowing costs. That may have rendered project financing a bit easier, translating into both improved backlog and more optimism regarding sales, employment and profit margins for the for the first half of 2024.

“Still, there remains cause for concern,” said Basu. “Recent data indicate that wage pressures persist, which makes it more likely that interest rates, and therefore project financing costs, will remain higher for longer. Geopolitical instability appears to be on the rise, raising the probability of a major conflagration that could further impact supply chains and potentially cause steep increases in certain energy prices.”

About ABC’s CBI and CCI

The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months. View the methodology for both indicators.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data

Additional Resources

- CFS Framing Manufacturing Volume for 2023 Rises 9.7% from 2022 Levels, SFIA Says

- FAQ: What Are Resilient Channels, and What Is Their Purpose?

- SFIA Releases Guide to the Performance-Based Nonstructural Partition Selection of Metal Framing

- Sorting Apples from Oranges — Comparing Evaluation Services with Third-Party Certification

- SFIA Releases Updated Technical Guide with the Most Up-to-Date CFS Load and Span Tables in the Industry