Several economists and industry organizations have issued reports indicating that the construction industry will be busy with work in 2022. Further reports show that cold-formed steel (CFS) framing will play a role in those growth prospects.

“The construction outlook for 2022 is looking positive, but the industry will face challenges,” said Anirban Basu, chief economist for Associated Builders and Contractors and CEO of consulting firm Sage Policy Group, in the Engineering News-Record article, “Economist Projects ‘Very Busy’ 2022 for Construction Industry.”

“I think that 2022 is going to be very busy for you all,” Basu said. “Think very long and hard before you enter into contractual obligations. Make sure you build enough margin and contingency.”

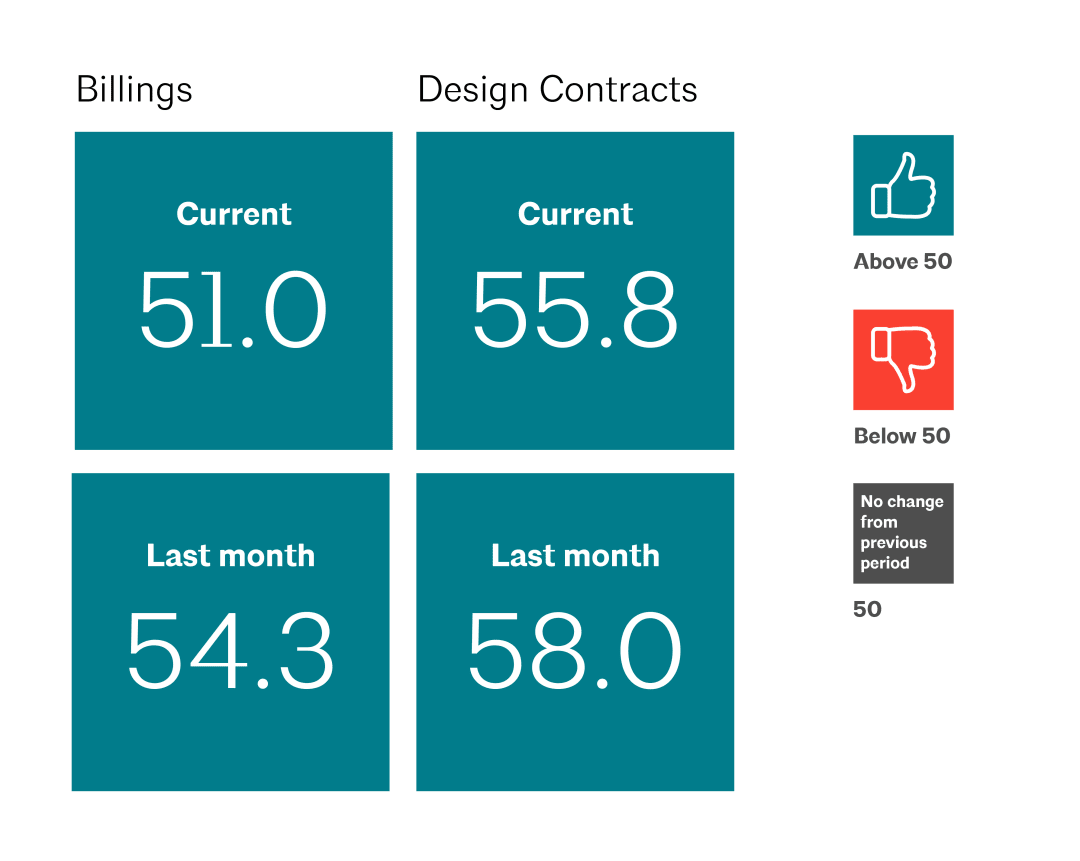

The AIA Architecture Billings Index was 51 in November 2021, a positive sign for projects in the pipeline.

2022: Another Strong Year

Many economists and construction industry observers have a positive view of 2022.

“Preparing for another strong year” is the 2022 engineering and construction industry outlook from Deloitte, a global network of member accounting firms.

In a recent Deloitte survey, 91% of engineering and construction respondents said they characterize the business outlook for their industry as somewhat or very positive, which was 23% higher than last year.

“Driving this business confidence is the expected strong performance of the residential segment and growth from the nonresidential segment due to the $1 trillion [Infrastructure Investment and Jobs Act] IIJA,” the Deloitte report said.

Ken Simonson, chief economist for the Associated General Contractors of America, recently shared his outlook in the “2022 Economic Forecast” webinar sponsored by the Foundation of the Wall and Ceiling Industry, the educational and research arm of the Association of the Wall and Ceiling Industry. As summarized in the article, “Look for Growth and High Input Prices in 2022,” Simonson said he expects to see more fulfillment centers and office remodeling projects this year.

The organizations behind two popular construction-related indices also report optimism for 2022:

- The Architecture Billings Index from the American Institute of Architects continues to read above 50, which means billings are growing at most architecture firms. The ABI is an economic indicator for nonresidential construction activity, with a lead time of approximately 9–12 months

- The Dodge Momentum Index from Dodge Construction Network, a monthly measure of the initial report for nonresidential building projects in planning, fell 4% in November 2021. Even so, the Momentum Index remains near a 14-year high. And, compared to November 2020, the Momentum Index was 44% higher in November 2021

The CFS framing industry provides a number of solutions for challenges faced by the construction industry.

Steel Framing Innovations Help Solve Challenges

Some economists see supply chain bottlenecks and material price inflation partially recovering this year.

While the prices of construction materials have risen rapidly over the past year, Basu told ENR that he “expects a more hawkish Federal Reserve may help limit the inflation rate to 3-4% next year, with a drop coming later in the year.”

“[This] could help lower the prices of materials like steel, copper and aluminum,” Basu said.

The CFS framing industry provides a number of solutions for challenges faced by the construction industry. These include labor savings through prefabrication on both non-residential commercial projects and multifamily residential projects.

- 3 Pandemic Construction Challenges Solved With Steel Framing – BuildSteel.org

- Veev’s Switch to Steel Framing Lowers Costs and Speeds Housing Construction – BuildSteel.org

Sable hotel at Chicago’s Navy Pier includes used CFS bearing walls and a floor joist system designed to spread the weight on the pier. Photo Credit: Hilton

Developers and Hoteliers Want to Build

Recently, ConstructionDive reported that “developers face a now-or-never moment to build.” The online news outlet said that obstacles such as inflation, pricing woes, the coronavirus and more will continue into 2022.

Despite such concerns, however, owners and developers “are actually pulling the trigger and signing contracts,” Deron Brown, president and chief operating officer of U.S. operations for Edmonton, Canada-based PCL Construction, told ConstructionDive.

Hospitality construction has been hard hit during the pandemic. But, Brown said his firm has begun the year with at least six hotel projects on the books. He said a lot of developers and hoteliers want to build. “Their estimating and pre-con departments are very busy,” Brown said.

Here again, the CFS framing industry is ready to play a large role in the fulfillment of such projects.

- Hotel Developers Look to Steel Framing for Offsite Construction – BuildSteel.org

- 592,000 Hotel Rooms in the US Pipeline – BuildSteel.org

- Navy Pier’s First Hotel Features Steel Framing to Reduce Weight – BuildSteel.org

The Steel Framing AdvantageCold-formed steel (CFS) leads the way as the preferred framing material for many structures for multiple reasons.

CFS is:

- A pre-engineered material that can be cut to exact lengths

- Dimensionally stable and does not expand or contract with changes in moisture content

- Lightweight compared to wood and concrete

- Resilient and will not warp, split, crack or creep when exposed to the elements

- Sustainable and 100% recyclable

- Durabile and has a high tensile strength

- Non-combustible and is a safeguard against fire accidents

Staying in Control of Materials

While market observers are generally optimistic about the construction economy, they remain cautious about the prospects for unbounded growth this year.

“Looking at 2022, I would say I’m nervously optimistic,” Simonson told Construction Dive. “Nonresidential construction, by and large, seems to have passed the low point and is on an upswing.”

While Simonson doesn’t expect material prices to return to pre-pandemic levels in 2022, he anticipates some up and down volatility, which is “better than the exclusively upward cost trajectory many material prices took through to the summer of 2021.”

“I’ve gotten more optimistic about material prices,” Simonson said.

Chip McAlpin, Association of the Wall and Ceiling Industry immediate past president and division president of the Jackson, Miss., and Louisiana offices of F.L. Crane & Sons, told AWCI’s Construction Dimensions that his firm orders materials sooner than is needed for projects as a strategy to beat pandemic-related supply chain issues.

“In the past, we may have shorted the order a little bit because we knew we could get it in a couple of days,” McAlpin says. “But that’s not an option now. We have to order earlier and with better planning.”

F.L. Crane crews have had to adjust to the new, accelerated ordering timetables. Ordering materials sooner means crews may have to forgo getting certain field measurements and thereby cutting CFS studs on site rather than pre-ordering exact lengths.

Even so, McAlpin said that F.L. Crane has no plans to inventory greater quantities of CFS studs and track, but only to order quantities sooner along project timelines.

“If we had one bundle of something all these years, we’re not going to start inventorying two bundles,” he said. “We’re just going to start ordering one more often.”

Include Wage Increases When Bidding

The construction industry added 22,000 net jobs in December, according to an ABC analysis of data released today by the U.S. Bureau of Labor Statistics.

- Overall, the industry has recovered slightly more than one million (92.1%) of the jobs lost during earlier pandemic stages

- Nonresidential construction employment expanded by 27,000 positions on net, with all three subcategories posting gains for the month

- Nonresidential specialty trade added 12,900 jobs, ABC said

“The labor market remains extremely tight going into 2022. Contractors will be competing fiercely for talent. They already have been, according to ABC’s Construction Confidence Indicator, but that competition will become even more intense as dollars from the infrastructure package flow into the economy,” said Basu. “Accordingly, contractors should expect another year of rapid wage increases in 2022. Those rising costs, along with others, must be included in bids if margins are to be sustained.”

Additional Resources

- The Steel Framing Industry Reports Big Gains During the Pandemic

- 9 Ways Construction Firms Are Dealing with the Labor Shortage

- Uniting an Industry Then and Now — SFIA’s 10-Year Anniversary