March 20, 2024

Business Conditions Remain Soft

February 2024

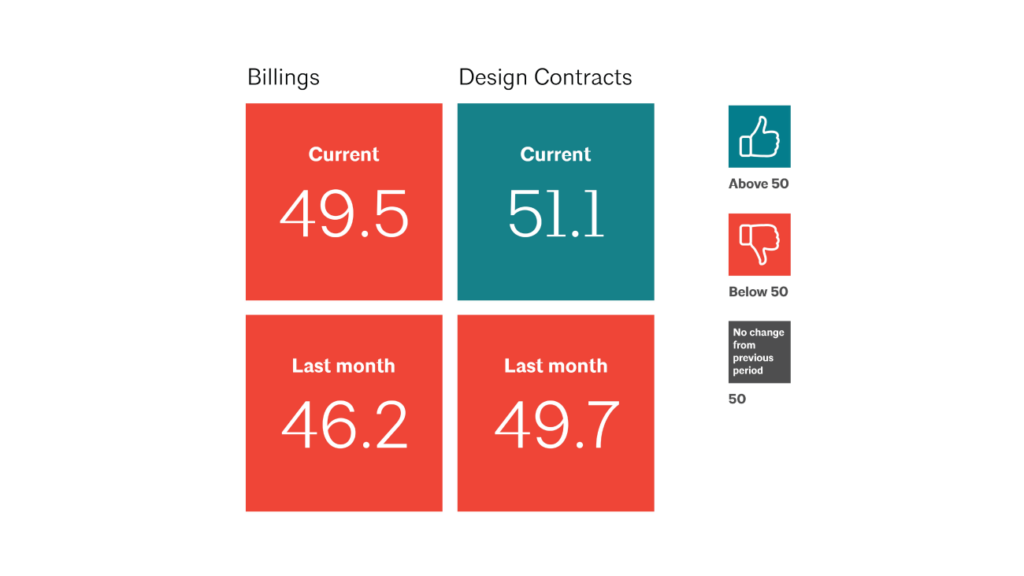

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

“There are indicators this month that business conditions at firms may finally begin to pick up in the coming months. Inquiries into new projects grew at their fastest pace since November, and the value of newly signed design contracts increased at their fastest pace since last summer,” said Kermit Baker, PhD, AIA Chief Economist.” Given the moderation of inflation for construction costs and prospects for lower interest rates in the coming months, there are positive signs for future growth.”

Midwest Reports Growth

The Midwest as a region is still reporting billings growth, despite business conditions remaining weak across the country in February. Firms located in the Midwest reported growth for the last three months, and for four of the last five months.

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

Architecture Billings Index (ABI)

The AIA/Deltek Architecture Billings Index (ABI) uses proprietary AIA data to predict nonresidential construction activity 9–12 months ahead. The ABI is derived from AIA’s Work-on-the-Boards survey, a trusted tool used by the design and construction industry to predict and track movements in the market. To learn more, visit aia.org/resource-center/aiadeltek-architecture-billings-index.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data

Additional Resources

- CFS Framing Manufacturing Volume for 2023 Rises 9.7% from 2022 Levels, SFIA Says

- FAQ: What Are Resilient Channels, and What Is Their Purpose?

- SFIA Releases Guide to the Performance-Based Nonstructural Partition Selection of Metal Framing

- Sorting Apples from Oranges — Comparing Evaluation Services with Third-Party Certification

- SFIA Releases Updated Technical Guide with the Most Up-to-Date CFS Load and Span Tables in the Industry