May 7, 2024

Data center projects dominated planning activity over the month

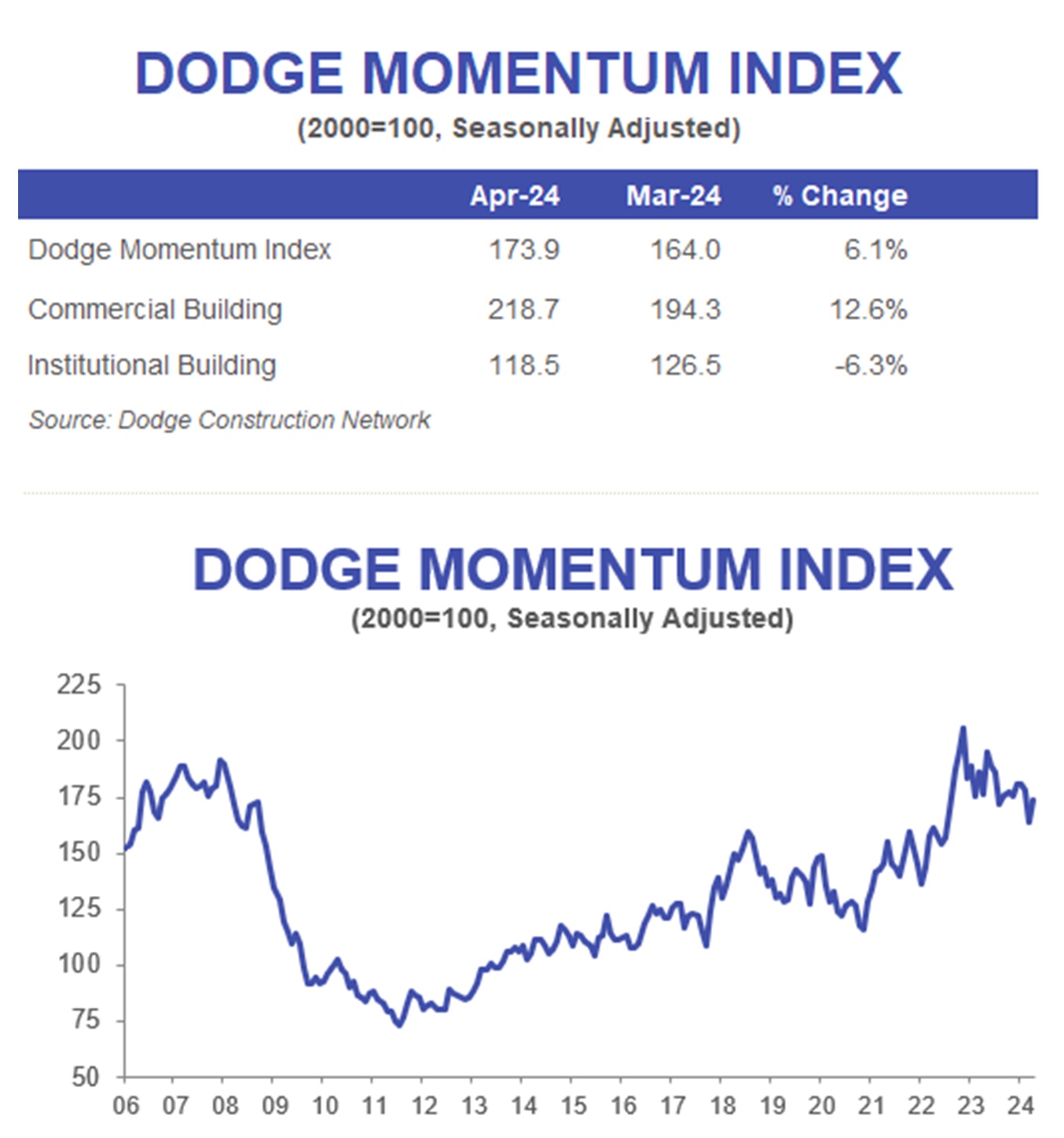

The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN), increased 6.1% in April to 173.9 (2000=100) from the revised March reading of 164.0. Over the month, commercial planning improved 12.6% and institutional planning dropped 6.3%.

“The Dodge Momentum Index (DMI) saw positive progress in April, alongside a deluge of data center projects that entered the planning stage,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Outsized demand to build Cloud and AI infrastructure is supporting above-average activity in the sector. Most other categories, however, faced slower growth over the month.”

Slower Growth in Office and Hotel Planning

A flood of data center projects entered planning in April, causing robust growth in the commercial segment of the DMI, while traditional office and hotel projects continued to face slower momentum. Warehouse planning was basically flat. On the institutional side, education and healthcare planning activity receded again – in part, driven by another month of weak life science and R&D laboratory activity. Year over year, the DMI was 1% lower than in April 2023. The commercial segment was up 6% from year-ago levels, while the institutional segment was down 15% over the same period.

25 Projects Valued at $100 Million

In April, a total of 25 projects valued at $100 million or more entered planning. The largest commercial projects included the $1 billion Convergent Technology Park in Remington, Virginia, the $630 million Dulles Digital Data Center (Buildings 8 and 6) in Dulles, Virginia, and the $330 million Google Red Hawk Data Center (Phase 2) in Mesa, Arizona. The largest institutional projects to enter planning were the $275 million Win-River Resort and Casino in Redding, California and the $254 million AdventHealth Hospital in Weaverville, North Carolina.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Read the original news release.

About Dodge Construction Network

Dodge Construction Network is a solutions technology company providing an offering of data, analytics, and industry-spanning relationships to generate information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem.

To learn more, visit construction.com.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data

Additional Resources

- CFS Framing Manufacturing Volume for 2023 Rises 9.7% from 2022 Levels, SFIA Says

- FAQ: What Are Resilient Channels, and What Is Their Purpose?

- SFIA Releases Guide to the Performance-Based Nonstructural Partition Selection of Metal Framing

- Sorting Apples from Oranges — Comparing Evaluation Services with Third-Party Certification

- SFIA Releases Updated Technical Guide with the Most Up-to-Date CFS Load and Span Tables in the Industry