March 12, 2024

Indicators Signal Growth Over Next 6 Months

February 2024

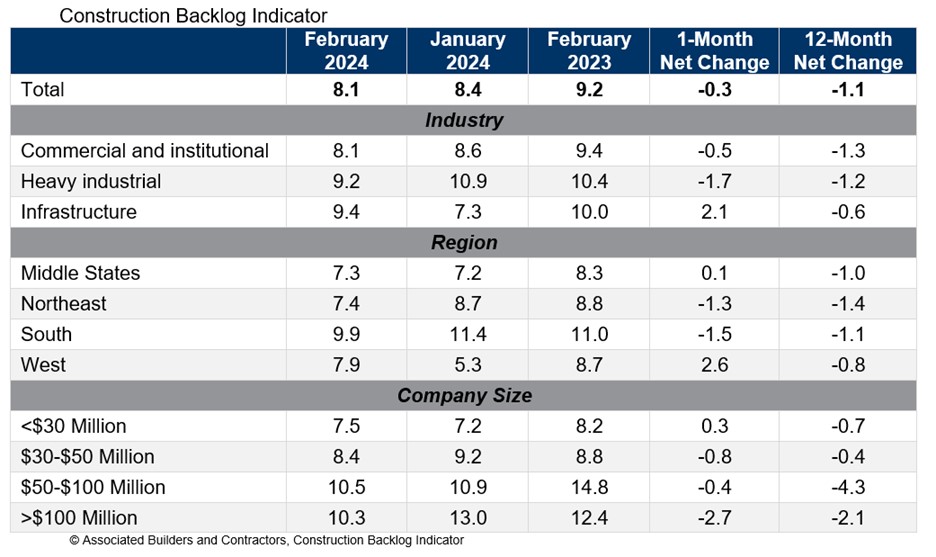

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

View the full Construction Backlog Indicator and Construction Confidence Index data series.

Construction Backlog Indicator

Backlog fell for every size of contractor except for those with under $30 million in annual revenues in February. Over the past year, however, the largest contractors—those with greater than $50 million in revenues—have experienced the greatest decline in backlog.

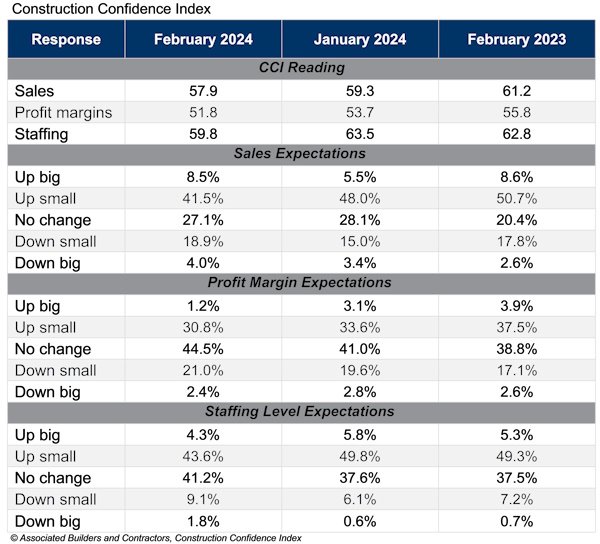

Construction Confidence Index

Construction Confidence Index

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels also decreased in February. However, all three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“Backlog is declining and confidence began to fade modestly in February,” said ABC Chief Economist Anirban Basu. “While it is far too early to predict an industrywide downturn given that confidence readings continue to signal growth along sales, employment and profit margin dimensions, it appears that a rising tide of project cancellations and postponements has begun to make its mark.

“With excess inflation remaining stubbornly durable, at least according to certain measures, interest rates are poised to remain higher for longer,” said Basu. “That gives higher borrowing costs more time to upset the economic momentum that has so surprised economists over the past two years and has provided support for various nonresidential construction activities. With so much federal money still entering the economy, there will continue to be support for growth in certain construction segments, including public works and manufacturing-related megaprojects, but industry weakness is more apparent in segments that rely more purely on private financing.”

About ABC’s CBI and CCI

The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months. View the methodology for both indicators.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data

Additional Resources

- CFS Framing Manufacturing Volume for 2023 Rises 9.7% from 2022 Levels, SFIA Says

- FAQ: What Are Resilient Channels, and What Is Their Purpose?

- SFIA Releases Guide to the Performance-Based Nonstructural Partition Selection of Metal Framing

- Sorting Apples from Oranges — Comparing Evaluation Services with Third-Party Certification

- SFIA Releases Updated Technical Guide with the Most Up-to-Date CFS Load and Span Tables in the Industry