February 7, 2024

Institutional planning continues to accelerate, while commercial planning ticks down

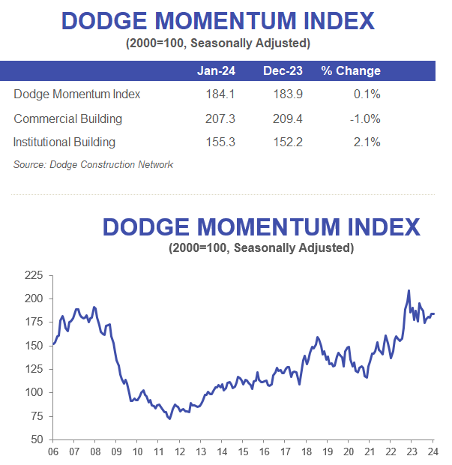

The Dodge Momentum Index (DMI), issued by Dodge Construction Network (DCN), rose 0.1% in January to 184.1 (2000=100) from the revised December reading of 183.9. Over the month, commercial planning fell 1.0% and institutional planning improved 2.1%.

“Divergent trends between commercial and institutional planning continued in January, nullifying any growth on the overall Momentum Index,” stated Sarah Martin, associate director of forecasting for DCN. “Nevertheless, lending standards begun to loosen in January and the Fed is expected to begin cutting rates in the back half of the year. With this in mind, momentum should resume in commercial activity throughout 2024 as owners and developers gain confidence in market conditions for 2025.”

DMI 3% Lower YoY

Slower growth in warehouse planning pulled down the commercial portion of the Index this month, while steady education and healthcare planning supported growth on the institutional side. Year over year, the DMI was 3% lower than in January 2023. The commercial segment was down 12% from year-ago levels, while the institutional segment was up 15% over the same period.

15 Projects Over $100 Million

A total of 15 projects valued at $100 million or more entered planning in January. The largest commercial projects included the $200 million renovation of the historic Magnolia Hotel in Dallas, Texas, and the $169 million Microsoft Data Center in Leesburg, Virginia. The largest institutional projects included the $224 million NREL laboratory in Golden, Colorado and the $223 million Wichita State University Biomedical building in Wichita, Kansas.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

Read the original news release.

About Dodge Construction Network

Dodge Construction Network is a solutions technology company providing an offering of data, analytics, and industry-spanning relationships to generate information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem.

To learn more, visit construction.com.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data

Additional Resources

- CFS Framing Manufacturing Volume for 2023 Rises 9.7% from 2022 Levels, SFIA Says

- FAQ: What Are Resilient Channels, and What Is Their Purpose?

- SFIA Releases Guide to the Performance-Based Nonstructural Partition Selection of Metal Framing

- Sorting Apples from Oranges — Comparing Evaluation Services with Third-Party Certification

- SFIA Releases Updated Technical Guide with the Most Up-to-Date CFS Load and Span Tables in the Industry