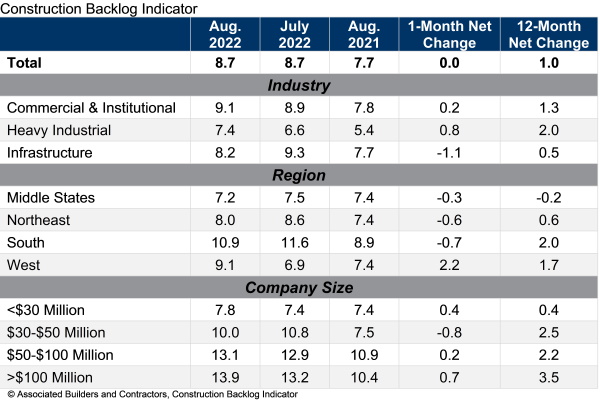

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.7 months in August as builders shook off fears of a looming recession, according to an ABC member survey conducted Aug. 22 to Sept. 7. The backlogs reading is a full month higher than in August 2021.

“The buoyancy of the nation’s nonresidential construction marketplace is really quite remarkable,” said Anirban Basu, ABC’s chief economist, in a release. “Rising interest rates have already driven the single-family homebuilding market into recession, but brisk nonresidential activity continues.”

Larry Williams, executive director of the Steel Framing Industry Association (SFIA), told steel framing contractors, suppliers, manufacturers and designers who are members of the Mid-Atlantic Steel Framing Alliance (MASFA) that the outlook for construction in 2023 is very promising.

“As the demand for cold-formed steel framing grows, we’re also seeing it evolve with the construction industry through more efficient product design, integration of optimized construction techniques and the use of new technologies for fabrication and assembly,” says Williams. “Today’s challenge with finding enough workers will be compounded by finding workers with skills that match this evolution, including data analysists, IT professionals and workers who are as familiar with pneumatics and hydraulics. Across the board steel framing remains one of the best positioned materials to benefit from the changes coming to construction in the next 10 to 15 years.”

Construction Backlog and Confidence Indices Reflect Optimism

The ABC’s Construction Backlog Indicator in August was highest for the Commercial and Institutional sectors, which tallied a 9.1 month backlog of work. The Heavy Industrial and Infrastructure sectors had backlogs of 7.4 months and 8.2 months respectively.

Regionally, the lengthiest construction backlogs occurred in the South (10.9 months) and the West (9.1 months). The Middle States and Northeast construction backlog indicators came in at 7.2 months and 8.0 months respectively.

Construction Confidence Index

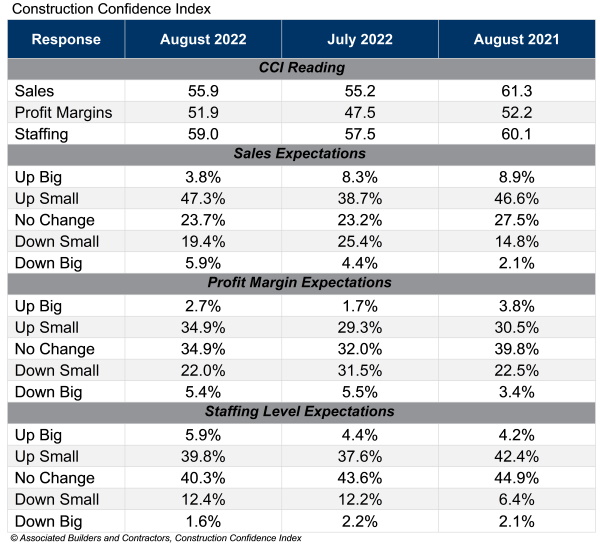

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased in August. The index for profit margins bounced back into positive territory while the sales and staffing level indices remained above 50, indicating expectations of growth over the next six months.

“Despite the high risk of recession, contractors collectively expect sales, employment and profit margins to grow over the next six months,” said Basu.

The survey results come despite the construction industry being hampered by skilled worker shortages, higher staffing costs and the Federal Reserve’s need to escalate its war on inflation with ever higher interest rates.

Construction Input Costs Dip 1.4%, Likely to Remain Elevated

The uptick in contractor confidence comes as construction input costs have dipped in August.

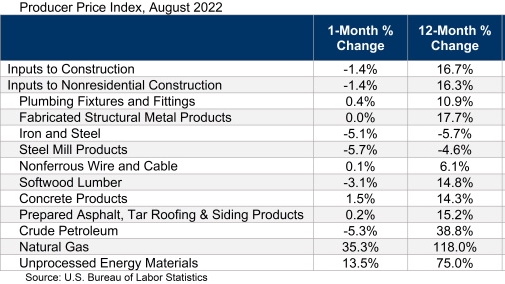

Construction input prices decreased 1.4% in August compared to the previous month, according to an ABC analysis of U.S. Bureau of Labor Statistics Producer Price Index data released on Sept. 14, 2022. Nonresidential construction input prices fell 1.4% for the month as well.

Construction input prices are up 16.7% from a year ago, while nonresidential construction input prices are 16.3% higher. Input prices were up in six of 11 subcategories* on a monthly basis. Natural gas prices increased 35.3% (and are 457.9% higher than they were in February 2020), followed by unprocessed energy materials prices, which rose 13.5%. Crude petroleum prices were down 5.3% in August.

“Today’s Producer Price Index report supplies additional evidence that wholesale inflation is edging lower from the highs observed earlier this year,” Basu said. “While this may create a sense of relief among contractors, this is no time for complacency.”

Basu suggested that construction materials and equipment prices are likely to remain elevated, noting that:

- COVID-19 lockdowns persist in China

- Europe faces severe energy crises

- Supply chain disruptions will persist

“That suggests that construction materials and equipment prices are likely to remain elevated even if year-over-year price increases moderate,” Basu said.

“The upshot is that inflation is poised to remain stubbornly high even as some begin to declare victory,” Basu added. “Estimators and others in the construction industry should be on guard for occasional surges in inflation during the months ahead.”

Steel Mill Product Prices Drop 5%, Lumber Jumps 15%, Over 12 Months

Based on the Producer Price Index, August 2022, provided by the U.S. Bureau of Labor Statistics, the price of materials and services used in nonresidential construction declined by 1.4 percent from July to August, as a steep drop in the prices of steel mill products masked increases in the cost of other construction inputs.

- Steel Mill Products: down 5.7% July to August 2022; down 4.6% last 12 months

- Softwood Lumber: down 3.1% July to August 2022; up 14.8% last 12 months

- Concrete Product: up 1.5% July to August 2022; up 14.3% last 12 months

The ABC release noted that many contractors expect to pass along their cost increases to project owners during the months ahead, but also said it is perfectly conceivable that project owners will become increasingly resistant to elevated charges for the delivery of construction services.

“Based on nonresidential construction spending data, that process has already begun,” Basu said. “Accordingly, contractors should remain laser-focused on cash flow and weeding out costs as opportunities arise.”

Additional Resources

- Steel Prices are Down, Demand is Easing and Supply Is, Well, Improving

- Manufacturing Volume of Cold-Formed Steel Framing Products Up 11.2% in Q2 2022

- 9 Ways Construction Firms Are Dealing with the Labor Shortage