With funding and support from the Foundation of the Wall and Ceiling Industry, the Association of the Wall and Ceiling Industry partnered with FMI to conduct a comprehensive survey and analysis of industry trends. The findings provide market insights that enable companies in the wall and ceiling industry to think strategically about the market and their businesses.

Download the AWCI / FMI report on the wall and ceiling industry.

Goals

The goal of the survey was to:

- Gauge AWCI member companies’ near-term sentiments on the performance of the overall economy, the construction industry and their businesses

- Explore areas of increasing importance and strategic priorities for their companies

- Determine top concerns among contractors, manufacturers and suppliers

- Assess member companies’ sentiments on the competitive landscape, current issues and business operations

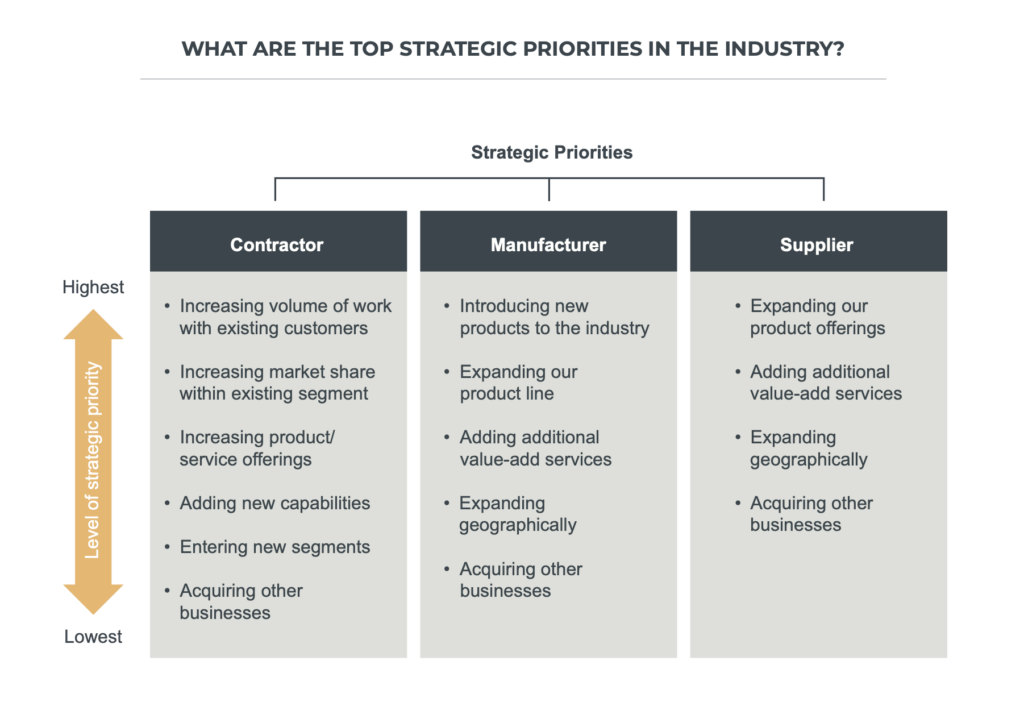

For manufacturers and suppliers, product and service expansion are top strategic priorities, while wall and ceiling contractors look to focus on their current customers.

Key Findings

The survey’s key findings include areas of segment demand, labor challenges and project delivery concerns.

Growth in Data Centers, Health-Care Facilities

A majority of respondents anticipate that data centers and health-care facilities will experience favorable growth into 2025. An increasingly remote workforce, growing digital storage and AI processing are fueling the demand for data centers. The aging population and need for outpatient facilities are driving new projects in health care.

Skilled Labor Shortage Persists

With a critical shortage in skilled labor and field management roles in the workforce for the past 18 months, 46% of contractors believe it will remain the same and only 28% anticipate improvement. The roles in most pressing need include skilled crafts/trades, field management, estimators/project managers and general labor.

Supply-Chain Disruptions Impact Operations

For both contractors and manufacturers, supply-chain disruptions have the most bearing on operations. Strategically, contractors plan to increase their volume of work with existing customers, while manufacturers and suppliers plan to expand product offerings and services.

“Moving forward with regular industry trend reports such as this, AWCI will be able to gauge changes in member sentiment and help determine potential implications to the wall and ceiling industry,” says Michael F. Stark, CAE, AWCI CEO.

About AWCI

The Association of the Wall and Ceiling Industry represents nearly 2,400 companies and organizations in the acoustics systems, ceiling systems, drywall systems, exterior insulation and finishing systems, fireproofing, insulation, prefabrication/panelization and stucco industries. Founded in 1918, AWCI’s mission is connecting people in the wall and ceiling industry to innovate, grow and succeed.

Additional Resources

- Manufacturing Volume of Steel Framing Products Rises 2.3% in Q2 vs. Q1, Says SFIA

- Cold-Formed Steel Framing Supports Shift to Modular Construction in Healthcare

- Steel—Doing It Right®: Steel Framing Materials