December 20, 2023

Business Conditions Remain Soft

November 2023

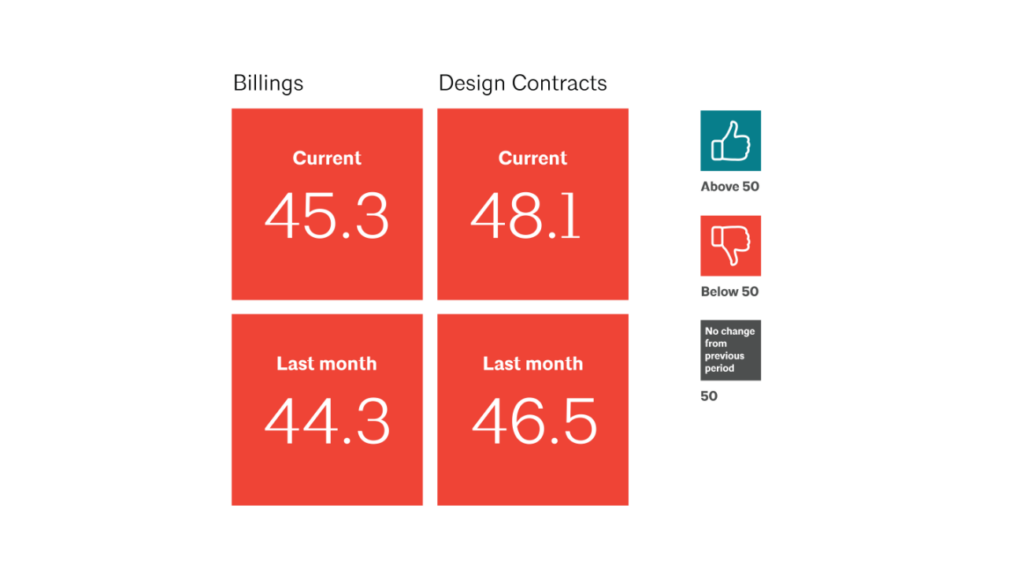

Business conditions remained soft at architecture firms in November, as the AIA/Deltek Architecture Billings Index (ABI) remained below 50 with a score of 45.3 for the month (any score below 50 indicates declining billings). The score increased by one point from October, indicating that slightly fewer firms reported a decline in billings in November, but the majority of firms continued to report weak business for the fourth consecutive month, and the seventh month so far this year. However, there are still some encouraging signs of potential work in the pipeline as inquiries bounced back in November after declining in October. And while the value of new signed design contracts continued to decrease in November, fewer firms reported a decline than in October.

Billings also remained weak at firms around the country in November, with firms in all regions reporting a decline for the fourth consecutive month. Business conditions remained softest at firms located in the West, which has been the case since March. And firms of all specializations also reported declining billings this month, with conditions remaining weakest at firms with a multifamily residential specialization. Billings also continued to decline further at firms with an institutional specialization, which was the strongest sector earlier this year.

Inflation persists, but interest rate relief may be coming

In the broader economy, conditions remain largely stable. Nonfarm payroll employment grew by an additional 199,000 jobs in November, on pace with recent trends, despite being somewhat below average monthly gains over the last year. Architectural services employment declined modestly in October, the most recent data available. Industry employment currently stands at 201,200; and while that is 2,500 below the most recent peak in July, it is 2,300 above where it was one year ago.

Inflation continues to moderate as well, with the Consumer Price Index (CPI) rising by an annual rate of 3.1% in November, well below the latest peak of 9.1% in June 2022, while inflation increased by just 0.1% from October. Energy prices have declined significantly in recent months, with gas prices declining by 6% in November and 5% in October. However, housing costs have continued to increase, with rent rising by 0.5% over the last month. With inflation continuing to improve, the Federal Reserve seems unlikely to raise interest rates further during their December meeting, even though inflation is still above their 2% target rate. Assuming inflation holds steady or improves further in the coming months, cuts to interest rates may start as early as mid-2024.

Firm leaders are optimistic about 2024, despite softer conditions this year

This month’s survey asked firm leaders our annual question about their biggest business-related concerns for the coming year and their general expectations for 2024. At least half of responding firm leaders rated negotiating appropriate project fees (54%) and increasing firm profitability (52%) as major concerns for 2024, while at least half rated managing possible merger and acquisition activity (67%), increasing firm post-construction work (e.g., post-occupancy analysis and monitoring) on existing buildings (52%), and reducing staffing costs (e.g., cutting hours, reducing headcount) (50%) as minor concerns for 2024.

When asked to select their top three business-related concerns for 2024 (of the issues that they rated as a major concern), increasing firm profitability topped the list as it does most years, with 30% of responding firm leaders selecting the issue as one of their top three concerns. The issue selected as one of the biggest concerns for 2024 by the second greatest share of firm leaders was managing the rising costs of running their firm (e.g., space rents, healthcare costs, liability insurance), which was selected by 22% of respondents. This was a significant increase from last year, when just 13% of firm leaders selected it as a top concern for 2023. And rounding out the top three concerns for 2024 was negotiating appropriate project fees, which was selected by 20% of responding firm leaders. For all three of these concerns, the share of firm leaders that selected them as one of their top three concerns for the coming year increased significantly from last year, as last year’s top concern, coping with volatile construction/building materials costs and availability, declined substantially this year as inflation continues to subside (selected as a top concern by 11% of respondents in 2023, versus 26% in 2022).

Rounding out the list of the top ten biggest business-related concerns for 2024 was identifying new clients and new markets/enhancing firm business planning/marketing (selected by 18%, up from 11% last year), filling open staff positions and finding candidates to fill key positions at firms (18%), dealing with firm ownership transition issues (17%), client challenges in availability of project financing and higher interest rates (15%) (newly added this year), retaining current staff and maintaining competitive salaries/dealing with staff compensation expectations (13%), and on-time payment from clients/managing receivables (10%), which was not in the top ten list last year. Half of the items in the list of the top ten biggest concerns for 2024 were related to project management, marketing, and development; three were related to firm management and strategy; and two were related to staffing and professional development. None were related to design and practice.

And overall, responding firm leaders are still generally optimistic about 2024, despite softer business conditions in the last few months. Nearly one in five expect a down year (18% expect a challenging year, 1% expect a potentially disastrous year), but nearly triple that share, 59%, expect a good (46%) to great (13%) year. The remaining 22% anticipate a so-so year. While there is generally not much difference by firm location, larger firms, and firms with an institutional specialization, tend to be slightly more optimistic about 2024 than other firms.

About the Architecture Billings Index (ABI)

The AIA/Deltek Architecture Billings Index (ABI) is a leading monthly economic indicator that uses proprietary AIA data to predict nonresidential construction activity 9–12 months ahead. The ABI is derived from AIA’s Work-on-the-Boards survey, which has gathered data on shifts in billings from architectural firm leaders for over 20 years. This data is a trusted tool used by the design and construction industry and other firms to predict and track movements in the market.

To learn more, visit aia.org/resource-center/aiadeltek-architecture-billings-index.

Get Cold-Formed Steel (CFS) Data

The Steel Framing Industry Association (SFIA) offers quarterly United States industry-wide statistical reports of the volume of cold-formed steel (CFS) (in raw tons before processing) used to produce CFS products. Two reports are available:

- Quarterly Market Data Report, a statistical summary by region and application (structural and nonstructural products)

- Quarterly Nonresidential Volume Report, a statistical summary with comparative data for the nonresidential market and indicators of prevailing market sentiment

Get CFS reports at steelframing.org/market-data